Tips to Bring Forward Your Tax Freedom Day

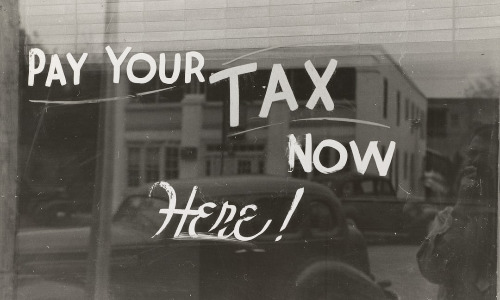

Tax Freedom Day has arrived on Thursday, 8th June this year. It marks the theoretical day when the average UK taxpayer has earned enough to cover all their taxes for the year. This includes income tax and taxes on goods and services.

The tax burden in the UK is currently the highest it has been since 1949. Many allowances have been frozen until 2028, and dividend and capital gains tax allowances are facing significant reductions. In 2023, an additional 232,000 people will be subjected to the 45% tax rate compared to the previous year. Fiscal drag, a phenomenon where the government freezes allowances instead of adjusting them for inflation, is causing more people to pay higher taxes.

According to Alex Davies, the founder and CEO of Wealth Club, British taxpayers work for the taxman for 159 days each year before they start earning for themselves. This means that Monday and Tuesday of every week are dedicated to covering tax bills. Unfortunately, the situation is not expected to improve in the near future. Projections indicate that Tax Freedom Day could be pushed back to 24th June by 2026, which would be the latest it has been since the early 1960s.

It’s no wonder that wealthy investors are increasingly turning to start-up businesses as a means to reduce their tax liabilities. A recent survey of Wealth Club clients revealed that tax incentives played a significant role in the success of Venture Capital Trusts (VCTs) in the past two tax years, with over £1 billion invested. Investment in companies eligible for the Enterprise Investment Scheme (EIS) also reached a record £2.3 billion in 2021/22.

In reality, everyone’s Tax Freedom Day varies, and fortunately, there are still legitimate ways to bring it forward. Here are some tips:

- Use your ISA allowances: Make the most of individual savings accounts (ISAs) by investing up to £20,000 (for 2023/24) in a Stocks & Shares ISA, a Cash ISA, or a combination of both. ISAs offer tax advantages, including no income tax on interest or dividends received and no capital gains tax on profits. These benefits become especially valuable in retirement if your expected income exceeds the annual income tax allowance.

- Use your pension: Saving into a pension remains a tax-efficient option. Enjoy pension tax relief at your marginal income tax rate, allowing you to top up a pension by £100 for a cost of £60 (for higher rate taxpayers) or £55 (for additional rate taxpayers). Take advantage of this generous relief while it lasts, keeping in mind that you may be liable for tax on income drawn during retirement if it exceeds income limits.

- Use your Capital Gains Tax Allowance: Individuals currently have a £6,000 annual capital gains tax allowance, meaning they can make £6,000 in capital gains before becoming liable for tax. This allowance will reduce to £3,000 from April 2024. To make the most of it, consider selling a well-performing fund and reinvesting in a similar one.

- Use your married couple allowance: If you’re married or in a civil partnership and under 88 years old, you may be eligible for the married couples’ allowance. This allows you to transfer £1,260 of your personal allowance to your spouse or civil partner if they earn more. Complete and return the necessary forms within your annual Self-Assessment tax return to claim this allowance.

- Invest in Venture Capital to get tax back: Venture Capital Trusts (VCTs) offer up to 30% income tax relief, allowing you to potentially receive £3,000 back on a £10,000 investment.